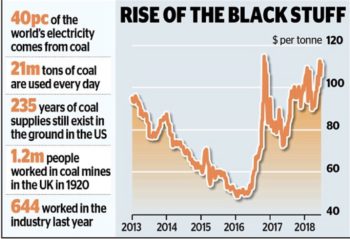

Although it may not be the most fashionable of assets, analysts are warming to coal. Analysts at investment bank Jefferies released a note to investors this month saying that ‘rumours of coal’s death are premature’. Ironically, lobbying by anti-fossil fuel activists to prevent new mines being built may have inadvertently helped to support coal prices. —Daily Mail, 30 June 2018

Coal is a dying industry, but luckily for the Australian economy, the rest of the world is not as smart as The Australian Greens and Labor Party and they are still buying it. “Coal is set to regain its spot as the nation’s biggest export earner amid higher prices and surging demand from Asia, sparking fresh calls from the Turnbull government for Labor to end its “war on coal”. —Jo Nova, 2 July 2018

Natural gas production from U.S. shale fields can keep growing for decades, giving Washington a powerful diplomatic tool to counter the geopolitical influence of other energy exporters such as Russia, industry executives and government officials said at a conference here. “We see a century of natural gas supply in U.S. shale,” Ryan Lance, chief executive of U.S. shale producer ConocoPhillips said this week at the triennial World Gas Conference in Washington. “Shale’s abundance is real and it’s not going away.” —Reuters, 27 June 2018

Two decades ago, an engineer tried a new way to get gas out of the ground. Energy markets and global politics would never be the same. “It is one of the most extraordinarily important, disruptive, technologically driven changes in the history of energy,” said Ed Morse, global head of commodity research at Citigroup. “It was revolutionary for the U.S. economy and it was revolutionary geopolitically.” —Russell Gold, The Wall Street Journal, 29 June 2018

China National Petroleum Corp. (CNPC), the largest state-owned producer of oil and natural gas in the country, reportedly plans to nearly double natural gas production from shale sources this year and wants a five-fold increase in such production by 2020. —Natural Gas Intel, 28 June 2018

A decade ago, the media was filled with stories about peak oil, numerous books were published on the subject, and even the Simpsons mentioned it in an episode about doomsday preppers. Now, the topic is largely forgotten and the flavor of the month is peak oil demand. Anyone concerned about the quality of research that works its way into the public debate should be curious about how so many were so wrong for so long. Very few people realize that the entire concerns about peak oil were based on misinformation or junk science. —Michael Lynch, Forbes, 29 June 2018

Think of all of these retirement funds that are divesting in fossil fuels. With that sector booming, they are losing a lot of money for the retirees, most of whom probably do not support the divestment. As I said many times, if something of value is sold, someone will buy it.

Enviromentalisms become a new age pagan religion where the worshipers of Gaia will sacrifice their own Freedom in their blind devotion to to their false religion